|

helpful government

links...

Thomas:

For Every Bill, Every Time, Call Tom: http://thomas.loc.gov Thomas:

For Every Bill, Every Time, Call Tom: http://thomas.loc.gov

government

printing office:

http://www.gpoaccess.gov/index.html

library

of congress:

http://lcweb.loc.gov/

200 Independence Avenue, SW (DHHS):

http://www.hhs.gov/

CM2 (the agency formerly known as HCFA):

http://www.cms.hhs.gov/default.asp?

national committee on vital and health statistics (NCVHS):

http://www.ncvhs.hhs.gov/

congressional budget office (CBO):

http://www.cbo.gov/

agency for health care research and quality (AHRQ):

http://www.ahrq.gov/ (the little

agency that could and a key agency for the future of US health care

reform)

agency for health care research and quality (AHRQ):

http://www.ahrq.gov/ (the little

agency that could and a key agency for the future of US health care

reform)

helpful association

links...

WEDi: http://www.wedi.org/

WEDi: http://www.wedi.org/

american health information management association (AHIMA):

http://www.ahima.org/ american health information management association (AHIMA):

http://www.ahima.org/

healthcare information management systems society (HIMSS):

http://www.himss.org/ASP/index.asp healthcare information management systems society (HIMSS):

http://www.himss.org/ASP/index.asp

helpful ppaca, hipaa and

other health care information technology links...

building a health

information technology foundation for health reform: a look at recent

guidance and funding opportunities: http://www.kff.org/healthreform/8132.cfm building a health

information technology foundation for health reform: a look at recent

guidance and funding opportunities: http://www.kff.org/healthreform/8132.cfm

an

introductory resource guide for implementing the hipaa security rule:

http://csrc.nist.gov/publications/drafts/DRAFT-sp800-66.pdf

about

the international classification of diseases, tenth edition, clinical

modification:

http://www.cdc.gov/nchs/about/otheract/icd9/abticd10.htm

pre-release, ICD-10-CM:

http://www.cdc.gov/nchs/about/otheract/icd9/icd10cm.htm

thoughtful jeanne

scott links…

the

health care blog:

http://www.thehealthcareblog.com/

wye

river group on healthcare:

http://www.wrgh.org/index.asp

the commonwealth

fund: http://www.cmwf.org/

funny jeanne scott links…

mark

fiore:

http://www.markfiore.com/

political strikes:

http://www.politicalstrikes.com/

will durst:

http://www.willdurst.com/

other helpful

documents, reports, studies and web sites…

(1)

...the Canonical list.

http://www.health-politics.com/resource.html#canon

(2)

... PPACA

Acronyms and Glossary.

http://www.health-politics.com/resource.html#acronym

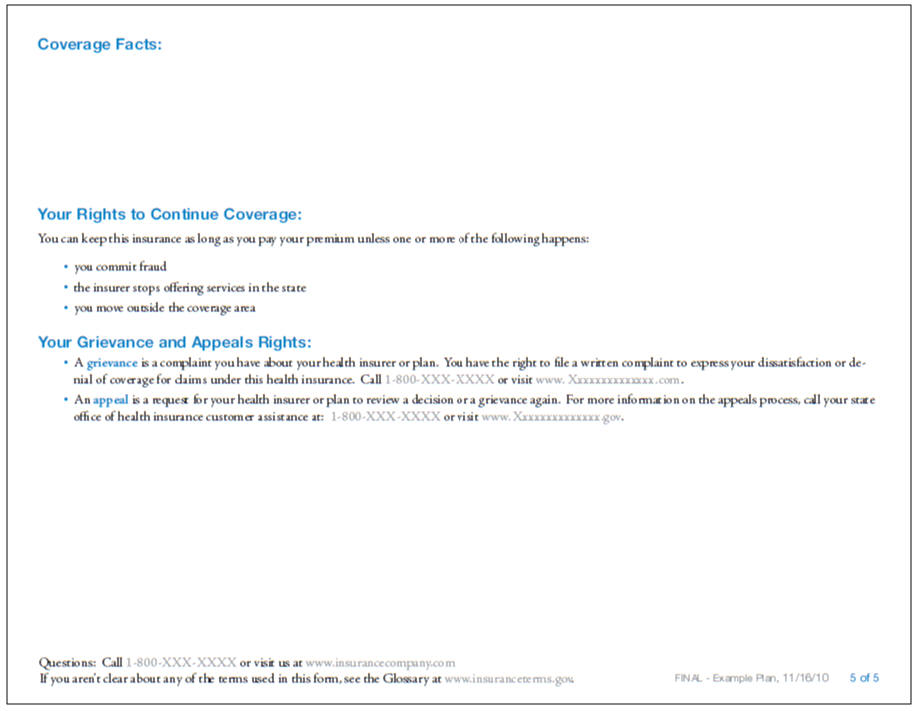

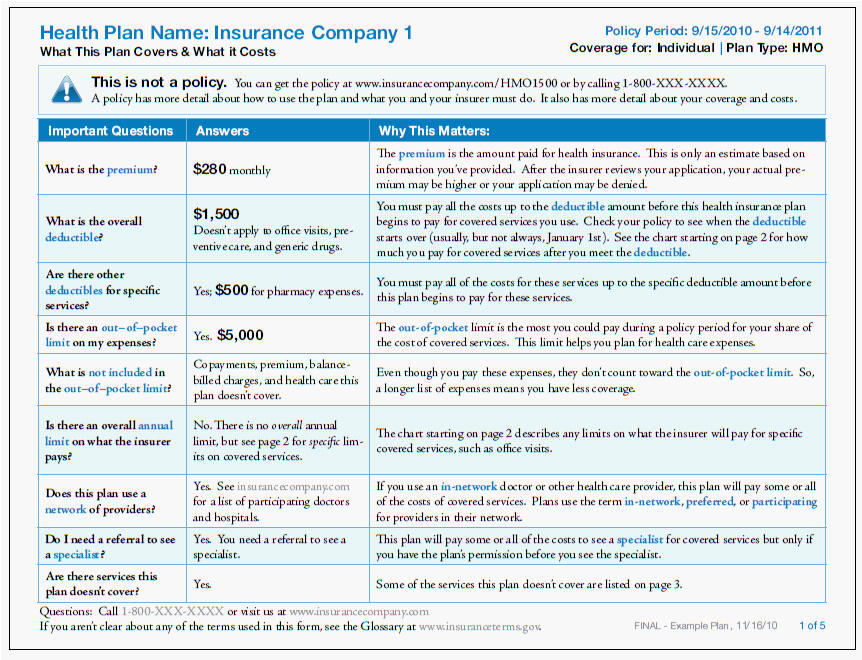

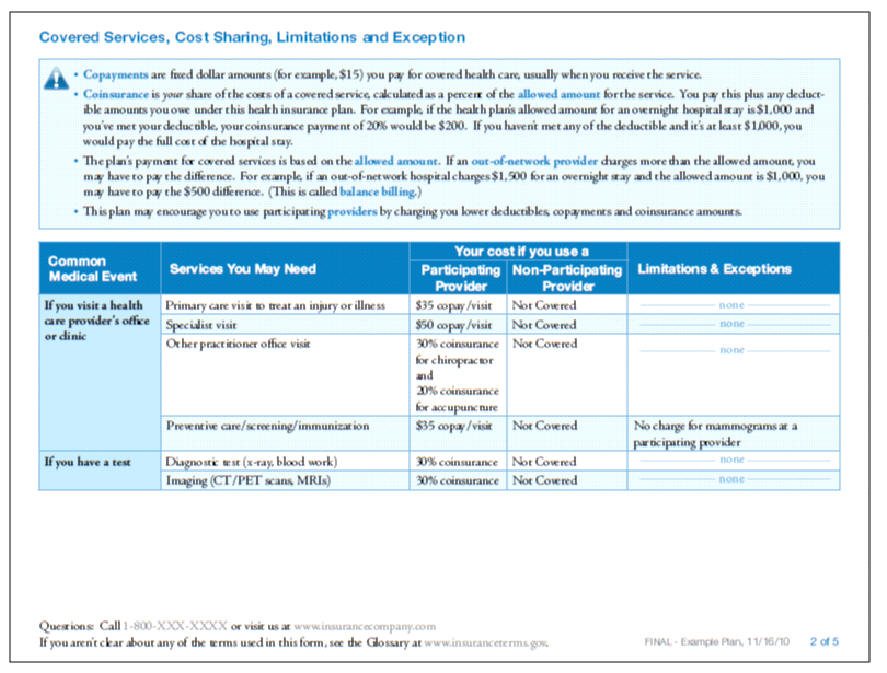

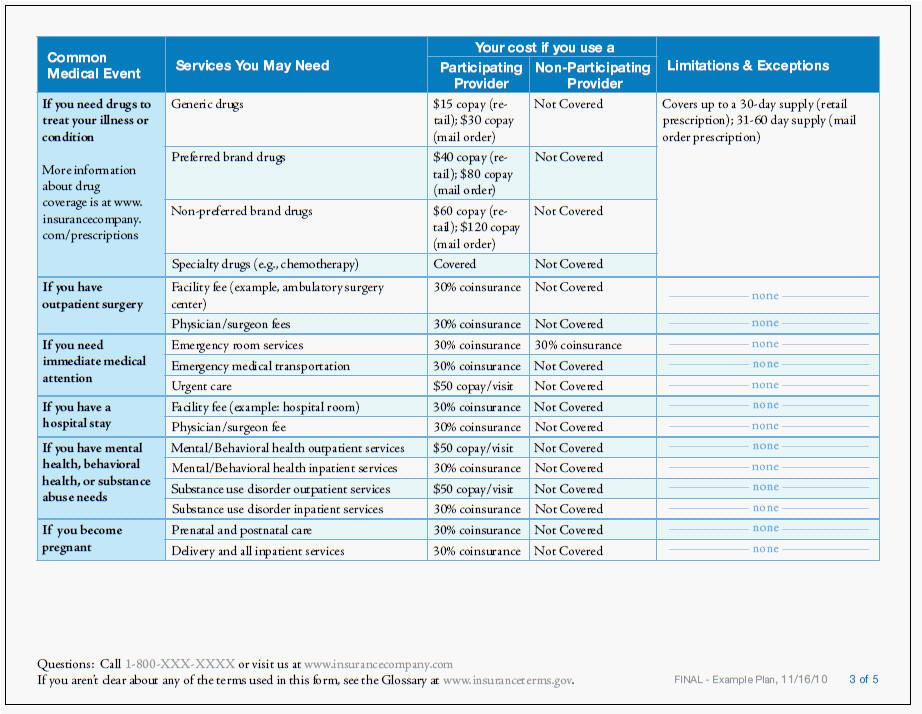

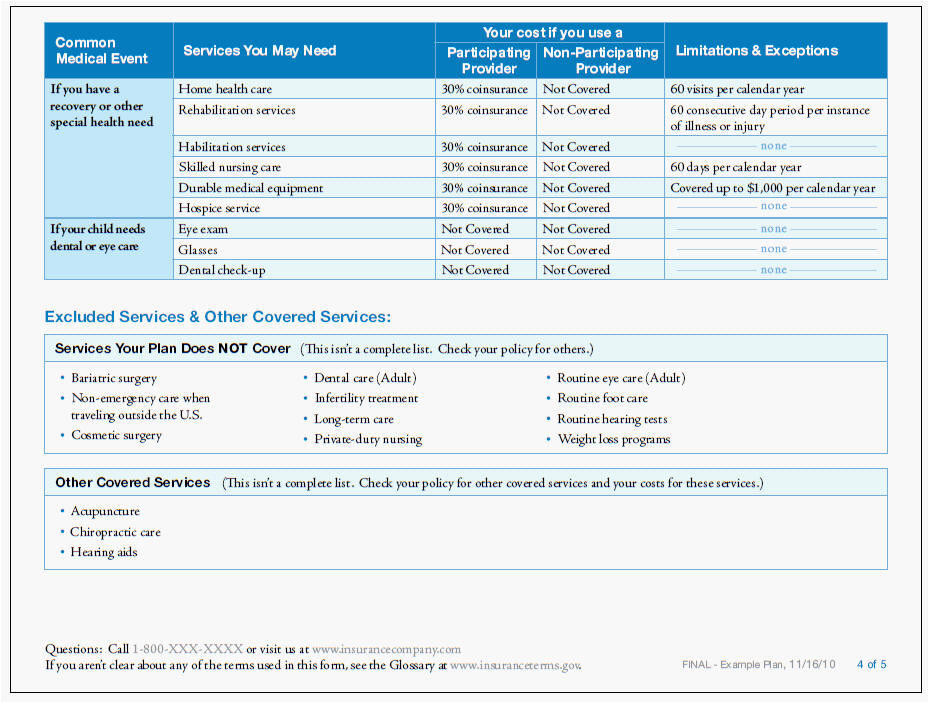

(3) ...

PPACA Seeks to Simplify Health Insurance

Forms and Help Consumers Make Better Choices.

http://www.health-politics.com/resource.html#forms

(4)

... Toward a Shared Vision of Payment Reform: A Commonwealth Fund White

Paper

http://www.commonwealthfund.org/~/media/Files/Publications/Other/2011/Shared_vision_payment_reform.pdf

(5)

...

Repealing Health Reform’s Maintenance of Effort Provision Could Cause

Millions of Children, Parents, Seniors, and People With Disabilities to

Lose Coverage ... Repeal Would Also Cause Loss of Jobs

http://www.cbpp.org/cms/index.cfm?fa=view&id=3397 (5)

...

Repealing Health Reform’s Maintenance of Effort Provision Could Cause

Millions of Children, Parents, Seniors, and People With Disabilities to

Lose Coverage ... Repeal Would Also Cause Loss of Jobs

http://www.cbpp.org/cms/index.cfm?fa=view&id=3397

(1) ...the Canonical list...

National Resources

HealthCare.gov

This

new website developed by the U.S. Department of Health and Human

Services helps you understand all the health insurance options available

in your local area for you and your family. After answering just a few

basic questions, the website's insurance finder will identify public and

private coverage options that might be right for you. You can receive

updates on the implementation of the new law and, as the website grows,

you will be able to research health plan quality ratings, learn about

disease prevention, and compare health plan prices all in one place. This

new website developed by the U.S. Department of Health and Human

Services helps you understand all the health insurance options available

in your local area for you and your family. After answering just a few

basic questions, the website's insurance finder will identify public and

private coverage options that might be right for you. You can receive

updates on the implementation of the new law and, as the website grows,

you will be able to research health plan quality ratings, learn about

disease prevention, and compare health plan prices all in one place.

Health Reform

GPS

RWJF and George Washington University have just

launched this new web-based platform that will serve as a high-level

guide to the health reform implementation process. The purpose of the

site is to open a window into the role and activities of the federal

agencies responsible for spearheading implementation and to attract

commentary on the endless array of policy questions that will inevitably

arise along the way. RWJF and George Washington University have just

launched this new web-based platform that will serve as a high-level

guide to the health reform implementation process. The purpose of the

site is to open a window into the role and activities of the federal

agencies responsible for spearheading implementation and to attract

commentary on the endless array of policy questions that will inevitably

arise along the way.

Closing the

Prescription Drug Coverage Gap

The Patient Protection and Affordable Care Act

("PPACA") passed and signed this year

contains some important benefits for Medicare recipients, including drug

benefits explained in this brochure. The $250 doughnut hole rebate is

the first step toward closing the Medicare prescription drug coverage

gap. If you reach the coverage gap in 2011, you will get a 50% discount

on your brand name prescription drugs at the time you buy them, unless

you are already getting Medicare Extra Help. Help

spread the word about this important benefit. And help stop scams

against seniors. Pass this brochure along to your friends, neighbors.

How Health Reform Helps the States

Families USA's state-specific one-page fact sheets designed for

advocates to use in their communities. Please customize these with your

own logo and contact information. (May 2010)

Health Reform: Why We Should

Celebrate

Families USA's PowerPoint presentation based on their piece, Help Is On

the Way: 12 Reasons to Embrace Health Reform. This is a simple and clear

tool that can be used to educate the public on the many ways that they

will benefit from the new law. It includes talking points, but we

encourage advocates to tailor the presentation to their audience. (May

2010) Families USA's PowerPoint presentation based on their piece, Help Is On

the Way: 12 Reasons to Embrace Health Reform. This is a simple and clear

tool that can be used to educate the public on the many ways that they

will benefit from the new law. It includes talking points, but we

encourage advocates to tailor the presentation to their audience. (May

2010)

Help Is On the Way: 12 Reasons to

Embrace Health Reform

Families USA's overview piece that discusses 12 key improvements in the

health reform law, which will benefit millions of Americans and their

families. (May 2010) Families USA's overview piece that discusses 12 key improvements in the

health reform law, which will benefit millions of Americans and their

families. (May 2010)

12 Reasons Campaign

Families USA's campaign launched on their microsite,

www.standupforhealthcare.org. Includes a blog post for each of the

12 reasons, showing how American families and businesses will be helped

by the new law. Please feel free to cross-post or share these blogs with

your social media networks—a quick and easy way to spread the word! (May

2010) Families USA's campaign launched on their microsite,

www.standupforhealthcare.org. Includes a blog post for each of the

12 reasons, showing how American families and businesses will be helped

by the new law. Please feel free to cross-post or share these blogs with

your social media networks—a quick and easy way to spread the word! (May

2010)

Roadblocks to Implementation

section of

Health Reform Central

Families USA has added updates on repeal/nullification efforts, advice

on how to respond to attacks, and legal arguments against

repeal/nullification. (May 2010) Families USA has added updates on repeal/nullification efforts, advice

on how to respond to attacks, and legal arguments against

repeal/nullification. (May 2010)

What Will Happen Under Health

Reform—And What's Next?

Newly enacted national health reform will begin, almost immediately, to

transform the U.S. health care system in ways large and small. The

changes will increase the number of people with health insurance, and

affect how many of us obtain coverage, how care is paid for and

delivered, and how it is regulated. Commonwealth Fund answers key

questions about health reform for journalists and others and provides a

timeline of reform milestones. Newly enacted national health reform will begin, almost immediately, to

transform the U.S. health care system in ways large and small. The

changes will increase the number of people with health insurance, and

affect how many of us obtain coverage, how care is paid for and

delivered, and how it is regulated. Commonwealth Fund answers key

questions about health reform for journalists and others and provides a

timeline of reform milestones.

Health Reform Law and Young Adults

Briefing Video/Podcast

Almost 14 million people between the ages of 19 and 29 were uninsured in

2008. The new health reform law requires insurers to allow dependent

children to remain on their parents' plans until age 26. But many

questions remain. On May 24, an Alliance for Health Reform/Commonwealth

Fund briefing in Washington, D.C., explored how the law affects young

people. A video and podcast of the briefing, courtesy of the Kaiser

Family Foundation, are available. Resource materials are also available

and a transcript from the briefing will be posted soon. Almost 14 million people between the ages of 19 and 29 were uninsured in

2008. The new health reform law requires insurers to allow dependent

children to remain on their parents' plans until age 26. But many

questions remain. On May 24, an Alliance for Health Reform/Commonwealth

Fund briefing in Washington, D.C., explored how the law affects young

people. A video and podcast of the briefing, courtesy of the Kaiser

Family Foundation, are available. Resource materials are also available

and a transcript from the briefing will be posted soon.

New Briefing on Payment Innovation:

What Lies Ahead Under Health Reform?

The health reform law will make several changes in the way health care

is paid for, particularly in public programs. A May 10 briefing

sponsored by the Alliance for Health Reform and The Commonwealth Fund,

"Pathways to Payment Innovation in a Post-Health Reform Era," explored

the major payment initiatives in the new law and their potential

effects. It explored such questions as: What role can payment changes

play in moving health care away from the fee-for-service system toward

value-based reimbursements? What can be learned from earlier public and

private efforts to better align payment incentives with program goals?

How will the new Center for Medicare and Medicaid Innovation work to

test new approaches, and then scale up the successful ones?

Presentations and other resources from the briefing are available on the

Alliance for Health Reform

Web site, and a webcast and podcast of the event are available on

the Kaiser Family Foundation's

site. The health reform law will make several changes in the way health care

is paid for, particularly in public programs. A May 10 briefing

sponsored by the Alliance for Health Reform and The Commonwealth Fund,

"Pathways to Payment Innovation in a Post-Health Reform Era," explored

the major payment initiatives in the new law and their potential

effects. It explored such questions as: What role can payment changes

play in moving health care away from the fee-for-service system toward

value-based reimbursements? What can be learned from earlier public and

private efforts to better align payment incentives with program goals?

How will the new Center for Medicare and Medicaid Innovation work to

test new approaches, and then scale up the successful ones?

Presentations and other resources from the briefing are available on the

Alliance for Health Reform

Web site, and a webcast and podcast of the event are available on

the Kaiser Family Foundation's

site.

Cover the Uninsured Health Care Reform Implementation

Resources – Website, Events Help, Twitter

Now

that health care reform has been signed into law, health care coverage

will be available to an additional 32 million uninsured Americans. This

legislation is a historic milestone that addresses many of the key areas

Cover the Uninsured organizers have been fighting for across the

country. You can

read more

about how health reform will impact your community on the Cover the

Uninsured website. Now is the time to host

enrollment events

to make sure eligible adults and kids get the low-cost or free coverage

they need through programs that are already available in your community.

You may also want to review the

Community Forum Guide

to engage community members and educate them on the changes that will be

implemented in your area. Cover the Uninsured will also keep you

up-to-date with e-mails and our

Twitter

feed.

Families USA Health Reform Implementation Central

As

health advocates, it’s important to make sure that the new law is

implemented effectively and in the most consumer-friendly way. Families

USA has created a new micro site,

Health Reform Central, which is designed to support you in

implementing all of the new protections and opportunities that health

reform will bring to your state. A few highlights include:

Understanding the new law; Repeal

efforts; and an

Interactive state page. As

health advocates, it’s important to make sure that the new law is

implemented effectively and in the most consumer-friendly way. Families

USA has created a new micro site,

Health Reform Central, which is designed to support you in

implementing all of the new protections and opportunities that health

reform will bring to your state. A few highlights include:

Understanding the new law; Repeal

efforts; and an

Interactive state page.

Seniors Worry About Medicare Reforms, Especially Changes To Medicare

Advantage

"While Democrats hail the sweeping legislation as the greatest expansion

of the social safety net since Medicare, they also fear that seniors

won't see it that way for this fall's elections. Indeed, Republicans

have portrayed the overhaul as a raid on Medicare - a bedrock of

retirement security - to provide money to pay for covering younger,

uninsured workers and their families. An Associated Press-GfK survey in

March found that 54 percent of seniors opposed the legislation that was

then taking final shape in Congress, compared with 36 percent of people

age 18-50. And last week a USA Today/Gallup Poll found that a majority

of seniors said passing the bill was a bad thing - while younger people

were positive about it. (4/1/2010, AP)

"Despite the central role that the individual mandate

plays in health care reform, proposals have been introduced in over 35

state legislatures to prevent the individual mandate from taking effect.

In addition, two lawsuits have been filed to challenge the individual

mandate? [Such s]tate nullification efforts almost certainly will be

unsuccessful in invalidating the new federal law. But efforts to nullify

the individual mandate could weaken political support for health reform

and make successful implementation at both the state and federal levels

more difficult to achieve." (4/7/10, CBPP) "Despite the central role that the individual mandate

plays in health care reform, proposals have been introduced in over 35

state legislatures to prevent the individual mandate from taking effect.

In addition, two lawsuits have been filed to challenge the individual

mandate? [Such s]tate nullification efforts almost certainly will be

unsuccessful in invalidating the new federal law. But efforts to nullify

the individual mandate could weaken political support for health reform

and make successful implementation at both the state and federal levels

more difficult to achieve." (4/7/10, CBPP)

New Health Initiatives Put Spotlight

On Prevention

Amid all the rancor leading up to passage of the new health care law,

Congress with little fanfare approved a set of wide-ranging public

initiatives to prevent disease and encourage healthy behavior. (4/10/10,

NYT)

Health Care Opinion Leaders: New Law

Will Provide Millions with Access to Affordable Coverage

By an overwhelming majority, leaders in health care and health policy

think the new health care reform law will successfully expand access to

affordable health insurance to the millions of Americans who currently

go without it. The latest

Commonwealth Fund/Modern Healthcare

Health Care Opinion Leaders survey—

which was fielded

while the legislation was still pending in Congress—also found that

virtually all key features of the health reform law are supported by a

large majority of opinion leaders. (April 2010, Commonwealth Fund) which was fielded

while the legislation was still pending in Congress—also found that

virtually all key features of the health reform law are supported by a

large majority of opinion leaders. (April 2010, Commonwealth Fund)

Online Resources

For Information On Health-Care Reform

The ink was hardly dry on the health-care overhaul law when foundations,

industry groups and consumer advocates began putting together guides to

the new rules. (4/6/10, Washington Post)

"Some opponents of health reform argue that

the new law’s individual mandate — the requirement that individuals must

have health coverage or face a penalty — should be repealed but the

law’s most popular insurance market reforms kept in place. These reforms

will bar insurers from denying coverage to people with pre-existing

conditions, charging higher premiums based on a person’s health status

or gender, or placing annual or lifetime caps on covered benefits. This

approach would be doomed to fail. An individual mandate is essential to

the success of insurance market reforms and to keeping premiums

affordable" (4/7/10, CBPP) "Some opponents of health reform argue that

the new law’s individual mandate — the requirement that individuals must

have health coverage or face a penalty — should be repealed but the

law’s most popular insurance market reforms kept in place. These reforms

will bar insurers from denying coverage to people with pre-existing

conditions, charging higher premiums based on a person’s health status

or gender, or placing annual or lifetime caps on covered benefits. This

approach would be doomed to fail. An individual mandate is essential to

the success of insurance market reforms and to keeping premiums

affordable" (4/7/10, CBPP)

REPORTS AND

STUDIES

Health Insurance Exchanges and the Affordable Care Act:

Key Policy Issues

examines 13 critical issues that federal and state

authorities must resolve if the new exchanges are to succeed: Ensuring

that exchanges don't become victims of "adverse selection"; Enrolling

enough individuals in exchanges to achieve sufficient market power,

economies of scale, and risk pool stability; Offering consumers choice

without complexity; Maximizing transparency and disclosure—one of the

most important tasks in the implementation process; Encouraging

competition among insurers on value and price. Keeping down

administrative costs of exchanges, as well as those of insurers and

employers; Establishing strong relationships between exchanges and

employers. (7/15/10, Commonwealth Fund) examines 13 critical issues that federal and state

authorities must resolve if the new exchanges are to succeed: Ensuring

that exchanges don't become victims of "adverse selection"; Enrolling

enough individuals in exchanges to achieve sufficient market power,

economies of scale, and risk pool stability; Offering consumers choice

without complexity; Maximizing transparency and disclosure—one of the

most important tasks in the implementation process; Encouraging

competition among insurers on value and price. Keeping down

administrative costs of exchanges, as well as those of insurers and

employers; Establishing strong relationships between exchanges and

employers. (7/15/10, Commonwealth Fund)

'Loss Ratio' Debate Proves Again That

Rulemaking Is as Hard as Lawmaking

Democrats outraged by insurance company profits designed

a piece of the new health care law to force insurers to direct most

premium money toward benefits. The law requires that, beginning in 2011,

large group plans spend 85 percent of premiums on clinical services and

activities related to quality of care. Only 15 percent can go to other

items, such as administrative costs, advertising and profits. For small

group and individual plans, it's 80 percent premiums and 20 percent

other costs. The law was otherwise fairly vague about what counts as

medical claims and what counts as administrative costs. For insurers,

the stakes are high because the decision could directly—and in some

cases adversely—affect companies' profits.

(6/25/10, CQ HealthBeat)

Implications Of Health Reform For

The Medical Technology Industry

The changes included in health reform include both positives and

negatives for the [medical technology] industry, but, on balance, the

industry is likely to thrive in the new era. However, the protection of

innovation is a crucial issue for both the industry and current and

future patients, who depend on medical progress for longer and healthier

lives (7/9/10, Health Affairs)

Loophole may let `mini-med' health insurance policies off the hook

The low annual payout limits on skimpy health

plans, including the state's own ``Cover Florida'' program, are supposed

to go away in September under new federal rules released this week. But

a close reading of the rules shows some wiggle room. (6/24/10,

Miami Herald)

HHS Estimates 200,000 to Gain Coverage Via 'Pre-Existing Condition

Insurance Plan'

Americans who have been uninsured for at least six months

and have been unable to obtain private health coverage because of a

pre-existing health condition can now apply for benefits through a new

program created by the health care overhaul law, the department of

Health and Human Services announced. (7/6/10,

Commonwealth Fund) Americans who have been uninsured for at least six months

and have been unable to obtain private health coverage because of a

pre-existing health condition can now apply for benefits through a new

program created by the health care overhaul law, the department of

Health and Human Services announced. (7/6/10,

Commonwealth Fund)

Web Site Launched to Help Consumers Find Plans—But May Quickly Become

Focal Point of New Law

The federal government went live with a much ballyhooed

Web site that helps consumers find health insurance options and explains

benefits under the new health care overhaul law. (7/6/10,

Commonwealth Fund) The federal government went live with a much ballyhooed

Web site that helps consumers find health insurance options and explains

benefits under the new health care overhaul law. (7/6/10,

Commonwealth Fund)

New Coverage for Uninsured People in Poor Health

The Obama administration is launching a special coverage program for

uninsured Americans with medical problems this week, the most ambitious

early investment of President Barack Obama's health care overhaul.

(6/30/10, AP)

Medicare Changes Could Shortchange Vulnerable Hospitals

The U.S. government's plan to base Medicare payments to hospitals on

certain quality-of-care measures could end up transferring funds away

from hospitals in the nation's poorest, underserved areas, an analysis

published Tuesday suggests. (6/29/10, Reuters)

Pressure Rising on Healthcare Long Before Overhaul Takes Effect

Despite passage of the landmark healthcare overhaul this spring, the

nation's existing health system is continuing to fray, raising the

prospect that the country could experience a crisis before the law

establishes a new safety net in 2014. (6/21/10, Los Angeles Times)

How Will Health Reform Affect States?

Health reform was enacted into law in Washington, D.C., but many of the

decisions around implementation will be made at the state level. In the

coming months and years, states will wrestle with the economic, legal

and clinical aspects of reform; their ability to successfully navigate

these issues will have a direct impact on tens of millions of

Americans. (6/21/10, RWJF) Health reform was enacted into law in Washington, D.C., but many of the

decisions around implementation will be made at the state level. In the

coming months and years, states will wrestle with the economic, legal

and clinical aspects of reform; their ability to successfully navigate

these issues will have a direct impact on tens of millions of

Americans. (6/21/10, RWJF)

What is the Evidence on Health Reform in Massachusetts and How Might

those Lessons Apply to National Health Reform?

As in Massachusetts, national reform includes expansions of public

programs, the creation of health insurance exchanges, subsidies for low-

and moderate-income individuals, an individual mandate, and requirements

for employers, among other provisions. Given the strong parallels

between Massachusetts’ health reform initiative and national health

reform, the experiences in the Bay State provide insights into the

potential effects of PPACA. (6/21/10, RWJF) As in Massachusetts, national reform includes expansions of public

programs, the creation of health insurance exchanges, subsidies for low-

and moderate-income individuals, an individual mandate, and requirements

for employers, among other provisions. Given the strong parallels

between Massachusetts’ health reform initiative and national health

reform, the experiences in the Bay State provide insights into the

potential effects of PPACA. (6/21/10, RWJF)

HHS to Spend $250 Million to Increase Number of Primary-Care Providers

In an attempt to address a national shortage of health-care workers,

Health and Human Services Secretary Kathleen Sebelius said Wednesday

that the federal government will spend $250 million in programs to

increase the number of doctors, nurses and other care providers.

(6/21/10, Washington Post)

State-Based Case Studies Explore the Costs and Adequacy of Safety Net

Access for the Uninsured

Despite the passage of the federal health reform

legislation, an estimated 20 million people will likely remain uninsured

and reliant on safety net care, making the efficacy of the nation’s

health care safety net a vital issue for policy-makers and health care

advocates. A new series of case studies being released by researchers at

Wake Forest University, in conjunction with the Robert Wood Johnson

Foundation, explores whether well-established safety net systems are

able to provide low-income uninsured people with access to high-quality

care at a reasonable cost. (June 2010, RWJF) Despite the passage of the federal health reform

legislation, an estimated 20 million people will likely remain uninsured

and reliant on safety net care, making the efficacy of the nation’s

health care safety net a vital issue for policy-makers and health care

advocates. A new series of case studies being released by researchers at

Wake Forest University, in conjunction with the Robert Wood Johnson

Foundation, explores whether well-established safety net systems are

able to provide low-income uninsured people with access to high-quality

care at a reasonable cost. (June 2010, RWJF)

Updated Medicaid Primer Explains Basic Components of Medicaid and the

Program’s Role in Health Reform

The Kaiser Family Foundation has updated Medicaid: A Primer, which

provides an overview of the basic components of Medicaid, the nation's

largest health coverage program. In light of the new health reform law,

the primer now examines how Medicaid will change and expand as it serves

as the mechanism to provide coverage to millions of previously uninsured

low-income adults and children. (6/23/10, KFF) The Kaiser Family Foundation has updated Medicaid: A Primer, which

provides an overview of the basic components of Medicaid, the nation's

largest health coverage program. In light of the new health reform law,

the primer now examines how Medicaid will change and expand as it serves

as the mechanism to provide coverage to millions of previously uninsured

low-income adults and children. (6/23/10, KFF)

Conversations: Mary K. Wakefield on Getting Ready to Double the Work of

Clinics

Mary K. Wakefield is the administrator of the Health Resources and

Services Administration, an agency of the U.S. Department of Health and

Human Services. The agency oversees community health centers across the

nation and programs that bring health care to the uninsured. (6/21/10,

Washington Post)

Poll: Favorable Views of Health Reform Law Increasing Among Americans

The health-care overhaul gained popularity from May to June, according

to a new tracking poll. (6/30/10, Washington Post)

New Health-Care Rules Could Add Costs, and Benefits, to Some Insurance

Plans

If you like your health plan, you can keep it. (6/15/10, Washington

Post)

Seeing Threat to Individual Policies, State Officials Urge a Gradual

Route to Change

State insurance officials say they fear that health insurance companies

will cancel policies and leave the individual insurance market in some

states because of a provision of the new health care law that requires

insurers to spend more of each premium dollar for the benefit of

consumers. (6/14/10, NYT)

States Resist HHS Control of Premiums

Some state insurance commissioners are pushing back against a renewed

effort on the Hill to centralize the authority of health insurance

premium rate reviews under the secretary of Health and Human Services.

(7/06/10, Politico)

Back To The Future: CBO Budget Predictions and Health Reform

Here we are again, arguing about whether health care reform will make

the government’s balance sheet better or worse. (7/06/10, KFF) Here we are again, arguing about whether health care reform will make

the government’s balance sheet better or worse. (7/06/10, KFF)

Making Health Care More Affordable: The New Premium and Cost-Sharing

Credits

explains what these credits are, who is eligible for

them, how much they’re worth, and how they can be used. (5/1/9/10, CBPP) explains what these credits are, who is eligible for

them, how much they’re worth, and how they can be used. (5/1/9/10, CBPP)

Rite of Passage: Young Adults and the Affordable Care Act of 2010

discusses provisions in the new law that will help young

adults gain health coverage. Key provisions include dependent coverage

up to age 26, a Medicaid expansion, new health insurance “exchanges,”

and subsidies to help people purchase private insurance. (May 2010, KFF) discusses provisions in the new law that will help young

adults gain health coverage. Key provisions include dependent coverage

up to age 26, a Medicaid expansion, new health insurance “exchanges,”

and subsidies to help people purchase private insurance. (May 2010, KFF)

What Women Need to Know about Health Reform: Making Health Care More

Affordable

explains that, on average, women are poorer and spend a

greater share of their income on care than men. Therefore, provisions

aimed at preventing medical bankruptcy and increasing access to

affordable coverage, whether through public programs or the private

market, will greatly benefit women. (June 2010, National Women’s Law

Center)

What Women Need to Know about Health Reform: Insurance Reforms

explains how women will benefit from these reforms given

that plans have routinely discriminated against women by using gender

rating, treating domestic violence as a pre-existing condition, and

denying coverage because they’ve had a c-section or breast cancer. New

insurance reforms and the “exchanges” will make it easier for women to

get coverage in a private market that treats everyone fairly. (June

2010, National Women’s Law Center)

What Women Need to Know about Health Reform: Improving Access to

Affordable Preventive Care

looks at how women will benefit from provisions in health

reform that expand coverage for preventive care in private plans,

Medicare, and Medicaid, and that eliminate cost-sharing for those

services. (June 2010, National Women’s Law Center)

Financing New Medicaid Coverage under Health Reform: The Role of the

Federal Government and States

explains that, while all states will see large increases

in federal financing, each state’s share of federal money will depend on

factors such as its Medicaid matching rate, decisions about coverage

made prior to reform, and participation rates. In general, states that

have the furthest to go to meet the new requirements will receive the

largest increases. (May 2010, KFF) explains that, while all states will see large increases

in federal financing, each state’s share of federal money will depend on

factors such as its Medicaid matching rate, decisions about coverage

made prior to reform, and participation rates. In general, states that

have the furthest to go to meet the new requirements will receive the

largest increases. (May 2010, KFF)

Medicaid Coverage and Spending in Health Reform: National and

State-by-State Results for Adults at or Below 133% FPL

shows that the planned Medicaid expansion will greatly

increase coverage, and the federal government will pay the majority of

the new cost. Any increases in state Medicaid spending will be small

compared to what states would have spent without reform. (May 2010, KFF) shows that the planned Medicaid expansion will greatly

increase coverage, and the federal government will pay the majority of

the new cost. Any increases in state Medicaid spending will be small

compared to what states would have spent without reform. (May 2010, KFF)

Medicaid Long-Term Services and Supports: Key Changes in the Health

Reform Law

outlines several provisions, such as the expansion of the

home- and community-based services state plan option, the community

first choice option, and the CLASS program. Implementation of these

provisions presents a new opportunity for states to expand access to

home- and community-based services in Medicaid. (June 2010, KFF) outlines several provisions, such as the expansion of the

home- and community-based services state plan option, the community

first choice option, and the CLASS program. Implementation of these

provisions presents a new opportunity for states to expand access to

home- and community-based services in Medicaid. (June 2010, KFF)

Financial Incentives for Health Care Providers and Consumers

looks at health reform’s efforts to employ financial

incentives to promote the use of effective health services and

discourage the use of marginally effective services. Under reform, HHS

will study the effectiveness of wellness programs, the impact of

incentives on consumer behavior, and the effectiveness of different

types of rewards to ensure that these incentives not only control costs,

but also improve the quality of care. (May 2010, Mathematica)

Understanding the CMS Actuary’s Report on Health Reform

describes

some of the report’s key findings and clears up some of the most common

misconceptions about the report. It explains that the actuary’s report

does not contradict the earlier CBO report, but rather supports its

findings. For example, both reports found that reform will expand health

coverage to more than 30 million people and slow the growth of health

care costs. (5/17/10, CBPP) describes

some of the report’s key findings and clears up some of the most common

misconceptions about the report. It explains that the actuary’s report

does not contradict the earlier CBO report, but rather supports its

findings. For example, both reports found that reform will expand health

coverage to more than 30 million people and slow the growth of health

care costs. (5/17/10, CBPP)

A New Era in American Health Care:

Realizing the Potential of Reform

Outlines the key features of the new reform law, discusses

who will be most helped and how, and describes the ways in which the

health care system will begin to provide more patient-centered,

accessible, and coordinated care to all Americans. Through a pragmatic

mix of public and private financing, the new Patient Protection and

Affordable Care Act will expand health care coverage, establish health

insurance market rules that protect individuals and families, and begin

to transform the health care system by encouraging greater value and

efficiency. (6/17/10, Commonwealth Fund) Outlines the key features of the new reform law, discusses

who will be most helped and how, and describes the ways in which the

health care system will begin to provide more patient-centered,

accessible, and coordinated care to all Americans. Through a pragmatic

mix of public and private financing, the new Patient Protection and

Affordable Care Act will expand health care coverage, establish health

insurance market rules that protect individuals and families, and begin

to transform the health care system by encouraging greater value and

efficiency. (6/17/10, Commonwealth Fund)

Medicaid Expansion in Health Reform

Not Likely to “Crowd Out” Private Insurance

"Contrary to claims by some critics, the Medicaid expansion in the new

health reform law will overwhelmingly provide coverage to people who

otherwise would be uninsured, rather than shift people who already have

private coverage to Medicaid." (6/22/10, CBPP) "Contrary to claims by some critics, the Medicaid expansion in the new

health reform law will overwhelmingly provide coverage to people who

otherwise would be uninsured, rather than shift people who already have

private coverage to Medicaid." (6/22/10, CBPP)

Childless Adults Who Become Eligible

for Medicaid in 2014 Should Receive Standard Benefits Package

"Among those who will qualify for Medicaid when the program is expanded

nationwide to 133 percent of the poverty line in 2014 are poor and

low-income adults who do not have a disability or live with an eligible

child, a group that is uninsured at higher rates and has greater health

care needs than other uninsured groups. The health reform law allows

states to provide newly eligible Medicaid beneficiaries either with the

regular Medicaid benefits package or with a less comprehensive package,

including one comparable to employer-sponsored health insurance. Given

their greater health needs, uninsured childless adults would be best

served by a comprehensive benefits package identical or comparable to

the package that Medicaid offers to low-income parents and people who

have disabilities. The federal government will pick up the vast

majority of the costs of this Medicaid expansion — 100 percent for the

first three years and 96 percent overall over the next ten years, so

this should be viable for states." (7/6/10, CBPP) "Among those who will qualify for Medicaid when the program is expanded

nationwide to 133 percent of the poverty line in 2014 are poor and

low-income adults who do not have a disability or live with an eligible

child, a group that is uninsured at higher rates and has greater health

care needs than other uninsured groups. The health reform law allows

states to provide newly eligible Medicaid beneficiaries either with the

regular Medicaid benefits package or with a less comprehensive package,

including one comparable to employer-sponsored health insurance. Given

their greater health needs, uninsured childless adults would be best

served by a comprehensive benefits package identical or comparable to

the package that Medicaid offers to low-income parents and people who

have disabilities. The federal government will pick up the vast

majority of the costs of this Medicaid expansion — 100 percent for the

first three years and 96 percent overall over the next ten years, so

this should be viable for states." (7/6/10, CBPP)

How Will the Health Care System

Change Under Health Reform?

Discusses the ways the new health reform law improves the

affordability of insurance for a variety of populations, including the

uninsured and the underinsured and older and younger adults. Explores

the lesser-known provisions of the Affordable Care Act that emphasize

preventive and primary care and reward health care quality. These key

features will ultimately push the health care system to deliver more

patient-centered, accessible, and coordinated care—improving our

experiences in the doctor's office and hospital. (6/29/10, Commonwealth

Fund) Discusses the ways the new health reform law improves the

affordability of insurance for a variety of populations, including the

uninsured and the underinsured and older and younger adults. Explores

the lesser-known provisions of the Affordable Care Act that emphasize

preventive and primary care and reward health care quality. These key

features will ultimately push the health care system to deliver more

patient-centered, accessible, and coordinated care—improving our

experiences in the doctor's office and hospital. (6/29/10, Commonwealth

Fund)

Moving toward

Health Equity: Health Reform Creates a Foundation for Eliminating

Disparities

summarizes provisions around investing in prevention and public health,

expanding access to coverage, and addressing disparities in health care.

(May 2010, Families USA) summarizes provisions around investing in prevention and public health,

expanding access to coverage, and addressing disparities in health care.

(May 2010, Families USA)

Información

Critica que Debe Saber Sobre La Reforma de Salud

(provides

information on the health reform law and answers frequently asked

questions about some of the most significant elements of the health

reform law for Latinos in Spanish.)

(2010, National Council of La Raza) (provides

information on the health reform law and answers frequently asked

questions about some of the most significant elements of the health

reform law for Latinos in Spanish.)

(2010, National Council of La Raza)

Health Reform:

How Consumers Will Be Affected

This series of brief reports funded by the Robert Wood Johnson

Foundation explores the effects health reform will have on consumers,

state governments, the economy, and health care costs. The latest

reports look at how different groups of health care consumers will be

affected. In these briefs, Urban Institute researchers focus on young

adults, children, seniors, and those who get their insurance from

individual or small-group markets. (7/6/10, RWJF) This series of brief reports funded by the Robert Wood Johnson

Foundation explores the effects health reform will have on consumers,

state governments, the economy, and health care costs. The latest

reports look at how different groups of health care consumers will be

affected. In these briefs, Urban Institute researchers focus on young

adults, children, seniors, and those who get their insurance from

individual or small-group markets. (7/6/10, RWJF)

Developing

Innovative Payment Approaches: Finding the Path to High Performance

T he

Center for Medicare and Medicaid Innovation, created by the new health

reform law, has a mandate to develop innovative payment models to

improve health care delivery. To achieve higher quality and slower cost

growth, the new center should be prepared to try a variety of approaches

that will encourage and reward more integrated care across the health

care continuum and work with other public programs and private payers

and purchasers to provide consistent incentives for providers and

patients. This paper addresses several issues related to facilitating

the process of identifying, developing, implementing, and monitoring new

initiatives, while recognizing the need to maintain the fiscal integrity

of the Medicare program and to focus on new initiatives that show

promise to improve quality and control costs. (6/8/10, Commonwealth

Fund) he

Center for Medicare and Medicaid Innovation, created by the new health

reform law, has a mandate to develop innovative payment models to

improve health care delivery. To achieve higher quality and slower cost

growth, the new center should be prepared to try a variety of approaches

that will encourage and reward more integrated care across the health

care continuum and work with other public programs and private payers

and purchasers to provide consistent incentives for providers and

patients. This paper addresses several issues related to facilitating

the process of identifying, developing, implementing, and monitoring new

initiatives, while recognizing the need to maintain the fiscal integrity

of the Medicare program and to focus on new initiatives that show

promise to improve quality and control costs. (6/8/10, Commonwealth

Fund)

U.S. Approaches

to Physician Payment: The Deconstruction of Primary Care

The authors explore the history of primary care physician reimbursement

and the current system within that context, and illustrate why physician

payment mechanisms are "inadequate for even basic primary care services,

let alone the fully implemented medical home." They argue that new,

hybrid payment models combining the best features of the standard

approaches "will likely be required to restore primary care to its

proper role in the U.S. health care system and to promote and sustain

the development of patient-centered medical homes."(6/3/10, Commonwealth

Fund) The authors explore the history of primary care physician reimbursement

and the current system within that context, and illustrate why physician

payment mechanisms are "inadequate for even basic primary care services,

let alone the fully implemented medical home." They argue that new,

hybrid payment models combining the best features of the standard

approaches "will likely be required to restore primary care to its

proper role in the U.S. health care system and to promote and sustain

the development of patient-centered medical homes."(6/3/10, Commonwealth

Fund)

MedPAC Urges

Changes in Doctor Training to Streamline Care

It didn't weigh in directly on the historic health care law, but the

Medicare Payment Advisory Commission (MedPAC) had no small impact on the

legislation, making recommendations that Democrats seized on to cut

Medicare spending and help pay for coverage of the uninsured. Now the

commission's impact could be felt once again—if Congress embraces its

new recommendations to change the training of doctors. (6/21/10,

Commonwealth Fund) It didn't weigh in directly on the historic health care law, but the

Medicare Payment Advisory Commission (MedPAC) had no small impact on the

legislation, making recommendations that Democrats seized on to cut

Medicare spending and help pay for coverage of the uninsured. Now the

commission's impact could be felt once again—if Congress embraces its

new recommendations to change the training of doctors. (6/21/10,

Commonwealth Fund)

HHS Rolls Out

$250 Million for Training Primary Care Providers

Health and Human Services (HHS) officials announced they'll devote $250

million to training for primary care providers needed to treat Americans

newly insured under the health care law and aging baby boomers. (6/21/10,

Commonwealth Fund) Health and Human Services (HHS) officials announced they'll devote $250

million to training for primary care providers needed to treat Americans

newly insured under the health care law and aging baby boomers. (6/21/10,

Commonwealth Fund)

Cuts to Medicare

Advantage Expected to Set Off a Chain of Blame

During a slow-moving political storm marked by what Harvard pollster

Robert Blendon calls "Level Four" anger, the last thing Democratic

candidates want to face in September is 11 million angry seniors. But

when seniors in Medicare Advantage—the popular program of private health

care plans in Medicare—open their mail this fall and find out how their

coverage will change next year, they won't be happy. (6/21/10,

Commonwealth Fund) During a slow-moving political storm marked by what Harvard pollster

Robert Blendon calls "Level Four" anger, the last thing Democratic

candidates want to face in September is 11 million angry seniors. But

when seniors in Medicare Advantage—the popular program of private health

care plans in Medicare—open their mail this fall and find out how their

coverage will change next year, they won't be happy. (6/21/10,

Commonwealth Fund)

What Will Happen

Under Health Reform--And What's Next?

Newly enacted national health reform will begin, almost immediately, to

transform the U.S. health care system in ways large and small. The

changes will increase the number of people with health insurance, and

affect how many of us obtain coverage, how care is paid for and

delivered, and how it is regulated. The report answers key questions

about health reform for journalists and others and provides a timeline

of reform milestones. (5/13/10, Commonwealth Fund supplement to the

Columbia Journalism Review)

The Impact of

Health Reform on Health System Spending

concludes that significant payment and system reform provisions in the

Patient Protection and Affordable Care Act will begin to realign

incentives within the health care system and reduce cost growth far in

excess of that predicted by the Congressional Budget Office and the

Centers for Medicare and Medicaid Services' Office of the Actuary. The

analysis finds that the health reform law will result in: total

reductions in health care spending of $590 billion from 2010 to 2019; a

reduction in the annual growth rate in national health expenditures from

6.3 percent to 5.7 percent from 2010 to 2019; savings of nearly $2,000

on annual health care premiums for the typical family by 2019; a

reduction in the deficit of up to $400 billion over 10 years; and

Medicare savings of $524 billion. (5/21/10, Commonwealth Fund) concludes that significant payment and system reform provisions in the

Patient Protection and Affordable Care Act will begin to realign

incentives within the health care system and reduce cost growth far in

excess of that predicted by the Congressional Budget Office and the

Centers for Medicare and Medicaid Services' Office of the Actuary. The

analysis finds that the health reform law will result in: total

reductions in health care spending of $590 billion from 2010 to 2019; a

reduction in the annual growth rate in national health expenditures from

6.3 percent to 5.7 percent from 2010 to 2019; savings of nearly $2,000

on annual health care premiums for the typical family by 2019; a

reduction in the deficit of up to $400 billion over 10 years; and

Medicare savings of $524 billion. (5/21/10, Commonwealth Fund)

Health Reform:

Help for Americans with Pre-Existing Conditions

Families USA examines the number of Americans diagnosed with

pre-existing conditions, who—absent reform—would be at risk of being

denied coverage in the individual insurance market. To better understand

the effect that health reform will have in Florida, Families USA also

released a state-specific report that reveals the number of Floridians

with pre-existing conditions who will benefit from reform in each age,

racial, and income group. Families USA examines the number of Americans diagnosed with

pre-existing conditions, who—absent reform—would be at risk of being

denied coverage in the individual insurance market. To better understand

the effect that health reform will have in Florida, Families USA also

released a state-specific report that reveals the number of Floridians

with pre-existing conditions who will benefit from reform in each age,

racial, and income group.

Near-Term

Changes in Health Insurance: Newly Enacted Health Reform Legislation

Mandates Dozens of Health Insurance Changes

details the provisions that go into

effect during the first two years. Some of the early changes include

requiring new health plans to eliminate cost-sharing for preventive

services, create internal and external appeals processes, and ban

pre-authorization requirements for emergency services. (4/30/10, Health

Affairs)

Making Health

Care More Affordable:The New Premium and Cost-Sharing Health Reform

"Under the new health reform law,

people of modest means will get help paying for health insurance

premiums and ‘cost-sharing’ expenses – costs that people with insurance

have to pay out-of-pocket like co-payments for doctor visits and

hospital care – beginning in 2014. This help will come in the form of

credits that will be available in the new health insurance exchanges."

(5/19/10, CBPP) "Under the new health reform law,

people of modest means will get help paying for health insurance

premiums and ‘cost-sharing’ expenses – costs that people with insurance

have to pay out-of-pocket like co-payments for doctor visits and

hospital care – beginning in 2014. This help will come in the form of

credits that will be available in the new health insurance exchanges."

(5/19/10, CBPP)

Understanding

the CMS Actuary’s Report on Health Reform

The analysis of the health reform

legislation prepared by the chief actuary of the Centers for Medicare &

Medicaid Services (CMS) has been widely misrepresented and

misunderstood. For example, the actuary does not estimate that health

reform will increase the federal deficit nor that health reform will

cost more than CBO estimates. This brief paper explains some of that

report’s key findings and clears up some of the most common

misunderstandings. (5/17/10, CBPP) The analysis of the health reform

legislation prepared by the chief actuary of the Centers for Medicare &

Medicaid Services (CMS) has been widely misrepresented and

misunderstood. For example, the actuary does not estimate that health

reform will increase the federal deficit nor that health reform will

cost more than CBO estimates. This brief paper explains some of that

report’s key findings and clears up some of the most common

misunderstandings. (5/17/10, CBPP)

7 Changes for

Medical Schools to Train Doctors for Reform Era Care

The U.S. must aggressively reform the way it trains its physicians if

they are to competently provide care to meet the mandates, hopes, and

expectations of health reform. (6/10/10, Carnegie Foundation)

Rite Of Passage:

Young Adults And The Affordable Care Act Of 2010

"As

of 2008, the number of uninsured young adults between the ages of 19 and

29 was nearing 14 million, representing three of

every 10 uninsured persons in the United States," write the authors

about provisions in the Patient Protection and Affordable Care Act of

2010. After reviewing historical data and detailing the new law, authors

of the

brief

conclude: "Young adults will benefit substantially from the ability to

remain on their parent's health plans, an unprecedented expansion in the

Medicaid

program, new insurance market regulations including bans on lifetime

limits and rating based on health status, subsidized private health

insurance with comprehensive benefits package through the new insurance

exchanges, and employer penalties for not offering health insurance"

(Collins and Nicholson, 5/21/10, Commonwealth Fund)

How Will Health

Reform Impact Young Adults?

"In 2014, most

uninsured young adults will either qualify for Medicaid or will be

eligible for subsidies for coverage they purchase in a health insurance

Exchange. The high cost of coverage is currently a major hurdle for

young adults looking for coverage, and the expansion of Medicaid and the

subsidies in the Exchanges are designed to make affordable coverage

available to more uninsured young adults in 2014. ... Gaining health

insurance will extend medical care and provide additional financial

security to young adults as they begin their adult lives" (5/13/10, KFF) "In 2014, most

uninsured young adults will either qualify for Medicaid or will be

eligible for subsidies for coverage they purchase in a health insurance

Exchange. The high cost of coverage is currently a major hurdle for

young adults looking for coverage, and the expansion of Medicaid and the

subsidies in the Exchanges are designed to make affordable coverage

available to more uninsured young adults in 2014. ... Gaining health

insurance will extend medical care and provide additional financial

security to young adults as they begin their adult lives" (5/13/10, KFF)

Young Adults

Gain New Coverage Option

"Under the health reform law, young adults up to their 26th birthday can

obtain health coverage through their parents’ health insurance plans.

This marks an important shift from the rules in effect now, under which

young adults usually lose access to their parents’ coverage once they

turn 19 or graduate from college. This brief explains the details and

the impact of the new policy." (6/9/10, CBPP) "Under the health reform law, young adults up to their 26th birthday can

obtain health coverage through their parents’ health insurance plans.

This marks an important shift from the rules in effect now, under which

young adults usually lose access to their parents’ coverage once they

turn 19 or graduate from college. This brief explains the details and

the impact of the new policy." (6/9/10, CBPP)

Health coverage

for an employee's children under age 27 is now tax-free under the

Patient Protection and Affordable Care Act

according to guidance issued by the Internal Revenue Service. Employers

with "cafeteria plans," which allow employees to choose from a menu of

tax-free benefit options and cash or taxable benefits, can allow

employees to immediately make pre-tax contributions to provide coverage

for children under age 27, even if the cafeteria plan has not yet been

amended to cover these individuals. Plan sponsors then have until the

end of 2010 to amend their cafeteria plan language to incorporate the

change. The tax benefit applies to various workplace and retiree health

plans, and to individuals who qualify for the self-employed health

insurance deduction on their federal income tax return. (4/2/8/10, AHA

News Now)

Health Coverage

for Young Adults: Health Reform Will Soon Allow You to Stay on Your

Parent's Health Plan

The

new health reform law gives new options to uninsured Americans under the

age of 26. Beginning in September 2010, all health plans that provide

dependent coverage for children must extend benefits to adult children

who meet certain eligibility criteria. The right to stay on a parent’s

plan will be especially helpful to young adults who are having

difficulty finding or affording health coverage in the current economy.

Although this provision of the law has not technically gone into effect

yet, many health plans are voluntarily offering young adults the

opportunity to stay on their parents’ plan now so that people who

are graduating from high school or college this spring will not have an

interruption in coverage. (May 2010, Families USA) The

new health reform law gives new options to uninsured Americans under the

age of 26. Beginning in September 2010, all health plans that provide

dependent coverage for children must extend benefits to adult children

who meet certain eligibility criteria. The right to stay on a parent’s

plan will be especially helpful to young adults who are having

difficulty finding or affording health coverage in the current economy.

Although this provision of the law has not technically gone into effect

yet, many health plans are voluntarily offering young adults the

opportunity to stay on their parents’ plan now so that people who

are graduating from high school or college this spring will not have an

interruption in coverage. (May 2010, Families USA)

Moving toward

Health Equity: Health Reform Creates a Foundation for Eliminating

Disparities

The

Patient Protection and Affordable Care Act, the health reform law that

was signed by President Obama in March, is designed to provide quality

and affordable health care to all Americans by expanding health

coverage, improving quality, and reducing costs. The new law also

provides a critical foundation for addressing racial and ethnic health

disparities through a number of key provisions—both those that will

affect everyone but have a disproportionate impact on communities of

color, as well as those that are designed specifically to eliminate

health disparities. This brief provides a summary of those provisions.

(May 2010, Families USA) The

Patient Protection and Affordable Care Act, the health reform law that

was signed by President Obama in March, is designed to provide quality

and affordable health care to all Americans by expanding health

coverage, improving quality, and reducing costs. The new law also

provides a critical foundation for addressing racial and ethnic health

disparities through a number of key provisions—both those that will

affect everyone but have a disproportionate impact on communities of

color, as well as those that are designed specifically to eliminate

health disparities. This brief provides a summary of those provisions.

(May 2010, Families USA)

Health Reform:

Help for Americans with Pre-Existing Conditions: State Reports

The new law offers

critical protections for the millions of Americans who have pre-existing

conditions today—as well as for those who are healthy now but who may

develop a health problem as they grow older. As a result of health

reform, no American with a pre-existing condition will be denied

coverage, charged a higher premium, or sold a policy that excludes

coverage of essential health benefits simply because he or she has a

pre-existing condition. This report takes a closer look at the number of

Americans with diagnosed pre-existing conditions who, absent reform,

would be at risk of being denied coverage in the individual insurance

market. The uninsured and those who do not have access to job-based

coverage are at greatest risk, but even those who now have coverage at

work could be at risk if they lose or leave their jobs and have to find

coverage in the individual market. (May 2010, Families USA) The new law offers

critical protections for the millions of Americans who have pre-existing

conditions today—as well as for those who are healthy now but who may

develop a health problem as they grow older. As a result of health

reform, no American with a pre-existing condition will be denied

coverage, charged a higher premium, or sold a policy that excludes

coverage of essential health benefits simply because he or she has a

pre-existing condition. This report takes a closer look at the number of

Americans with diagnosed pre-existing conditions who, absent reform,

would be at risk of being denied coverage in the individual insurance

market. The uninsured and those who do not have access to job-based

coverage are at greatest risk, but even those who now have coverage at

work could be at risk if they lose or leave their jobs and have to find

coverage in the individual market. (May 2010, Families USA)

Companies Leap

at Chance to Share in $5 Billion from Health Care Law

The White House is

looking for good news to spread these days when it comes to the new

health care law, and found it in the form of a study from Hewitt

Associates. Hewitt, a consulting firm, said it conducted a survey that

found that most employers who offer retiree health benefits plan to

participate in a new program that would offset their costs for early

retiree medical claims. (6/1/10,

Commonwealth Fund) The White House is

looking for good news to spread these days when it comes to the new

health care law, and found it in the form of a study from Hewitt

Associates. Hewitt, a consulting firm, said it conducted a survey that

found that most employers who offer retiree health benefits plan to

participate in a new program that would offset their costs for early

retiree medical claims. (6/1/10,

Commonwealth Fund)

Government Run

Health Care

Through demographic change and the economic downturn—and regardless of

reform—the public-sector share of health spending in 2010 will exceed 50

percent for the first time. What do we do now? (5/4/10, H&HN Online)

Health Reform's

Impact: Health Spending to Shrink by $590 Billion, Family Premiums by

$2,000, Over Next Decade

New estimates show that

the health reform law could reduce annual growth in health care spending

from 6.3 percent to 5.7 percent over the next decade—a savings of $590

billion—while lowering annual premiums by nearly $2,000 for the typical

family and extending coverage to 32 million previously uninsured

individuals by 2019. The analysis concludes that significant payment and

system reform provisions in the Patient Protection and Affordable Care

Act will begin to realign incentives within the health care system and

reduce cost growth to a greater extent than predicted by the CBO and the

CMS Office of the Actuary.

(5/21/10, Center for American Progress)

New CBO Estimate

Raises Cost of Health Reform Legislation

The director of the Congressional Budget Office said that the health

care reform legislation could cost, over the next 10 years, $115 billion

more than previously thought, bringing the total cost potentially to

more than $1 trillion. CBO revised the figure due to estimated

discretionary costs to federal agencies as they implement the new health

care reform legislation - such as administrative expenses for the IRS

and DHHS - and the costs for a "variety of grant and other program

spending for which specified funding levels for one or more years are

provided in the act." The new figure is based on estimates of how

Congress will decide to spend money. CBO cautions that lawmakers could

decide to spend less. (5/12/10, AHA News Now)

New Report on

How Health Care Reform Will Help Prevent and Reduce Obesity

There’s a new report out from the Center for American

Progress, entitled, Confronting America’s Childhood Obesity Epidemic –

How the Health Care Reform Law Will Help Prevent and Reduce Obesity.

This report highlights provisions with “the potential to address

childhood obesity,” including nutrition labeling in fast food

restaurants, the childhood obesity demonstration program, and community

transformation grant provisions. (May 2010, Center for American

Progress)

Brief Summarizes

and Explains the Aspects of Health Reform that Take Effect in 2010 and

2011

In a new policy brief, the near-term effects of the Patient Protection

and Affordable Care Act are examined and enumerated, providing context

for key immediate reforms to the private health insurance market that

will take effect in 2010 and 2011. Early insurance market reforms are

associated with two goals of health care reform: (1) reducing barriers

to health insurance and (2) improving the availability of information in

the health care marketplace. (5/4/10, Health Affairs/RWJF) In a new policy brief, the near-term effects of the Patient Protection

and Affordable Care Act are examined and enumerated, providing context

for key immediate reforms to the private health insurance market that

will take effect in 2010 and 2011. Early insurance market reforms are

associated with two goals of health care reform: (1) reducing barriers

to health insurance and (2) improving the availability of information in

the health care marketplace. (5/4/10, Health Affairs/RWJF)

Key Health

Insurance Market Reforms Not Achievable Without an Individual Mandate

Some opponents of health reform argue that the new law’s individual

mandate — the requirement that individuals must have health coverage or

face a penalty — should be repealed but the law’s most popular insurance

market reforms kept in place. These reforms will bar insurers from

denying coverage to people with pre-existing conditions, charging higher

premiums based on a person’s health status or gender, or placing annual

or lifetime caps on covered benefits. This approach would be doomed to

fail. An individual mandate is essential to the success of insurance

market reforms and to keeping premiums affordable. (5/4/10, CBPP) Some opponents of health reform argue that the new law’s individual

mandate — the requirement that individuals must have health coverage or

face a penalty — should be repealed but the law’s most popular insurance

market reforms kept in place. These reforms will bar insurers from

denying coverage to people with pre-existing conditions, charging higher

premiums based on a person’s health status or gender, or placing annual

or lifetime caps on covered benefits. This approach would be doomed to

fail. An individual mandate is essential to the success of insurance

market reforms and to keeping premiums affordable. (5/4/10, CBPP)

Making Health

Care More Affordable: The New Premium and Cost-Sharing Credits

Under the new health reform law, people of modest means will get help

paying for health insurance premiums and “cost-sharing” expenses – costs

that people with insurance have to pay out-of-pocket like co-payments

for doctor visits and hospital care – beginning in 2014. This help will

come in the form of credits that will be available in the new health

insurance exchanges. By providing low- and moderate-income families with

affordable health insurance options, the premium and cost-sharing

credits will reduce the number of people without health coverage and

allow such families to comply with the new requirement to obtain

coverage starting in 2014. Without these subsidies, the new requirement

would place undue burdens on low- and moderate-income people who could

otherwise face the choice of paying for basic necessities such as

housing and food, or purchasing insurance. This brief explains who is

eligible for premium and cost-sharing credits and how they work.

(5/19/10, CBPP) Under the new health reform law, people of modest means will get help

paying for health insurance premiums and “cost-sharing” expenses – costs

that people with insurance have to pay out-of-pocket like co-payments

for doctor visits and hospital care – beginning in 2014. This help will

come in the form of credits that will be available in the new health

insurance exchanges. By providing low- and moderate-income families with

affordable health insurance options, the premium and cost-sharing

credits will reduce the number of people without health coverage and

allow such families to comply with the new requirement to obtain

coverage starting in 2014. Without these subsidies, the new requirement

would place undue burdens on low- and moderate-income people who could

otherwise face the choice of paying for basic necessities such as

housing and food, or purchasing insurance. This brief explains who is

eligible for premium and cost-sharing credits and how they work.

(5/19/10, CBPP)

Health Reform Is

a Good Deal for States

Contrary to claims that the health reform law’s Medicaid expansion will

place an unaffordable burden on states, the federal government will

shoulder nearly all of the cost of the expansion, which will cover 16

million low-income children and adults while raising state Medicaid

spending by just 1.25 percent compared to what states were projected to

spend without health reform. And health reform as a whole, by greatly

expanding health coverage, will result in some reduction in states’

costs for providing care to the uninsured. (4/26/10, CBPP) Contrary to claims that the health reform law’s Medicaid expansion will

place an unaffordable burden on states, the federal government will

shoulder nearly all of the cost of the expansion, which will cover 16

million low-income children and adults while raising state Medicaid

spending by just 1.25 percent compared to what states were projected to

spend without health reform. And health reform as a whole, by greatly

expanding health coverage, will result in some reduction in states’

costs for providing care to the uninsured. (4/26/10, CBPP)

CLASS: A New

Voluntary Long-Term Care Insurance Program

The new health reform law

establishes a federal, voluntary long-term care insurance program, known

as Community Living Assistance Services and Supports, or CLASS. This

brief paper describes the need for CLASS, explains its benefits and

financing, and corrects some misconceptions about the program's effect

on the federal budget. (4/16/10, CBPP) The new health reform law